Case Study - Gensol Engineering Ltd

SEBI Takes Action Against Gensol Promoters

In a recent interim order, SEBI has taken strong action against the promoters of Gensol Engineering Limited, Anmol Singh Jaggi and Puneet Singh Jaggi:

1. Restrained from holding any position as Director or Key Managerial Personnel (KMP) in Gensol.

2. Barred from buying, selling, or dealing in securities until further notice.

These actions follow a series of developments that raised significant concerns regarding corporate governance, financial integrity, and promoter conduct.

Key Red Flags Identified

Promoter Activity

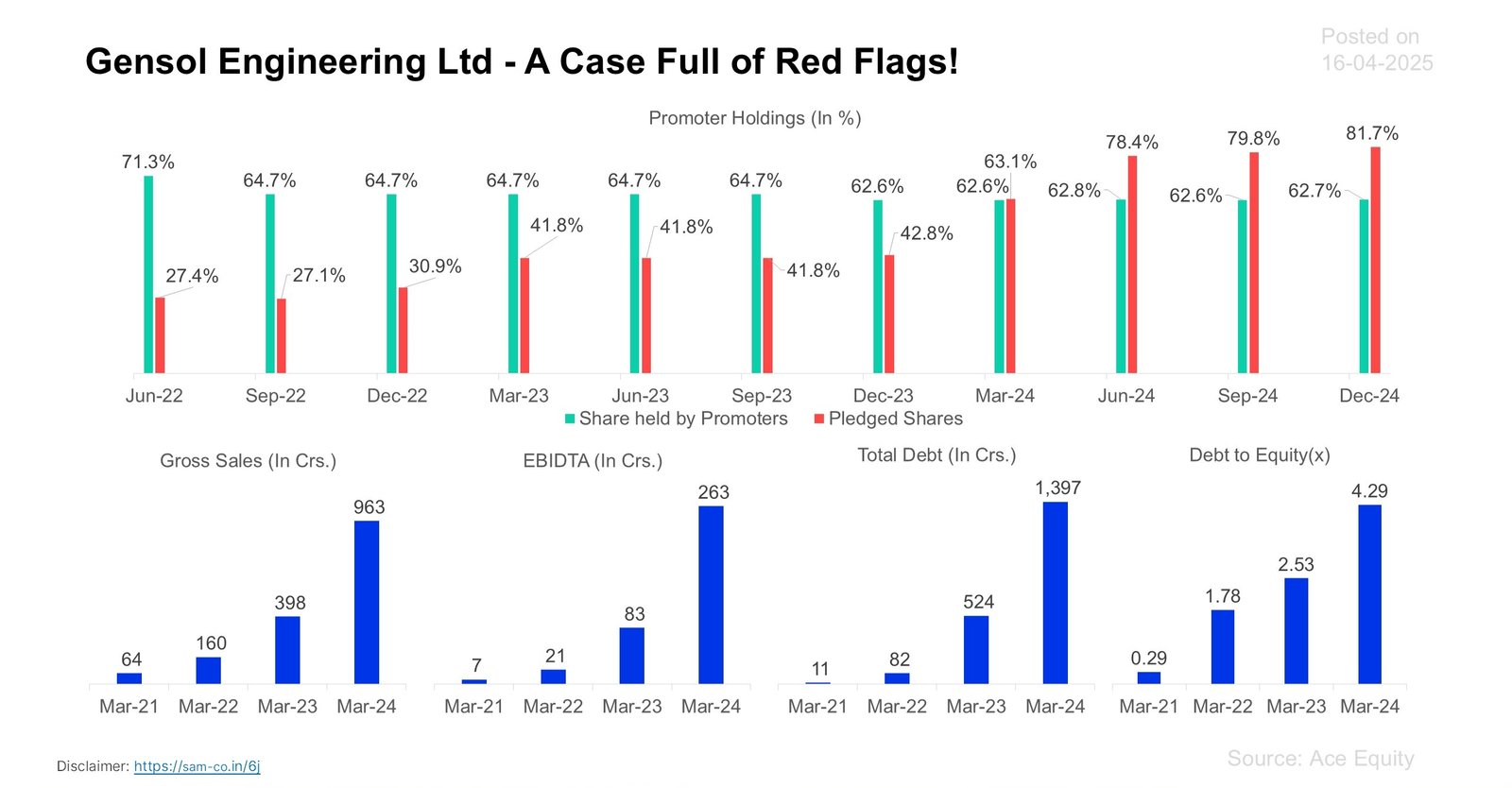

• Between June 2022 and December 2024, promoter shareholding decreased from 71.3% to 62.7%.

• During the same period, the proportion of pledged shares rose sharply from 27.4% to 62.7%, indicating increasing financial pressure.

Financials Show Rapid Growth

• From FY21 to FY24, Gensol’s consolidated sales grew 15 times, while EBITDA increased 37 times.

• This led to a 59x rise in the share price between March 2021 and June 2024.

However, this extraordinary growth masked deeper issues related to leverage and governance.

Debt Surge and Credit Rating Downgrade

• Total debt increased 132 times from March 2021 to March 2024.

• The debt-to-equity ratio rose from 0.29 to 4.29, rendering the company highly leveraged.

This prompted ICRA to downgrade Gensol’s credit rating from BBB to D, which is typically reserved for junk-grade debt. ICRA also flagged concerns over potential falsification of loan repayment documents submitted by the company.

As a result, Gensol’s share price declined by nearly 90% over the following weeks.

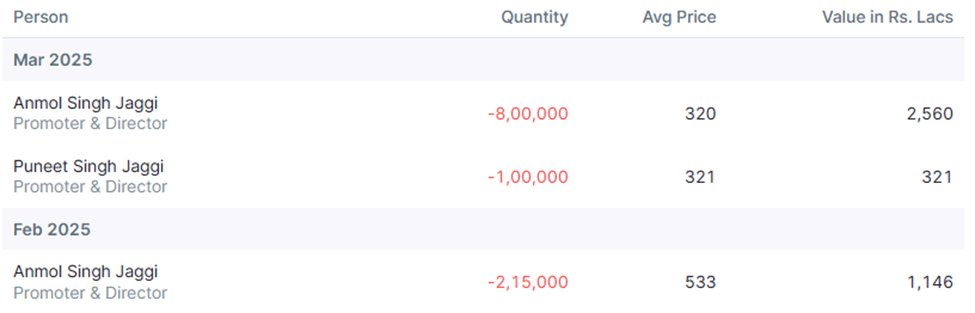

Continued Promoter Selling

Despite issuing positive public statements, the promoters sold 11.15 lakh shares in the open market during February and March 2025, further eroding investor confidence.

(Source: Screener.in)

Previous Legal Trouble

The promoters had previously come under investigation in connection with the Mahadev Betting Scam involving Harish Tibrewal. The Enforcement Directorate had frozen their shares during the course of the investigation.

(Source: Screener.in)

SEBI Uncovers Misuse of EV Funds

SEBI’s interim order has outlined how funds, originally intended for electric vehicle procurement, were diverted toward the purchase of a luxury apartment in DLF’s Camellias project.

Timeline of Transactions:

• September 29, 2022:

Jasminder Kaur, mother of the promoters, paid ₹5 crore to DLF as an apartment booking advance. SEBI found this amount originated from Gensol.

• September 30, 2022:

Gensol received ₹71.39 crore from IREDA (a government institution) as an EV loan and infused ₹26.06 crore of promoter contribution into its Trust and Retention Account, totaling ₹97.46 crore.

• October 3, 2022:

₹93.88 crore was transferred by Gensol to Go-Auto Pvt Ltd, a related entity.

Go-Auto then transferred ₹50 crore to Capbridge Ventures LLP, where the promoters are partners.

• October 6, 2022:

Capbridge Ventures LLP paid ₹42.94 crore to DLF as the main payment for the apartment.

• October 20, 2022:

The apartment was formally allotted to Jasminder Kaur.

• Subsequently:

The property allotment was transferred to Capbridge Ventures LLP.

• November 21, 2022:

DLF refunded the initial ₹5 crore advance to Jasminder Kaur.

Instead of being returned to Gensol, it was diverted to another related party, Matrix Gas and Renewables Ltd.

SEBI’s Findings and Conclusion

SEBI concluded the following:

• Funds meant for business expansion were diverted through a series of related-party transactions to finance a luxury apartment for personal benefit.

• The structure of the transactions was designed to conceal the actual purpose of fund deployment.

• These actions reflect severe lapses in corporate governance and misuse of public and institutional funds.

Investors are reminded to look beyond surface-level growth metrics and closely monitor promoter conduct, leverage levels, and regulatory disclosures. These elements often reveal the true financial health and intent behind corporate actions.

(Source: Ace Equity, Screener.in, SEBI)

3694 Comments

как сделать подписчиков в тг канале

услуга контент-маркетинга Консультация по маркетингу Консультация по маркетингу – это возможность получить экспертное мнение и практические рекомендации по развитию вашего бизнеса от опытного маркетолога. Это возможность посмотреть на свой бизнес со стороны, выявить проблемные зоны и получить инструменты для их решения. Что вы получите на консультации: Анализ текущей ситуации: Оценка вашего текущего маркетингового положения, выявление сильных и слабых сторон, определение возможностей для роста. Определение целей: Помощь в определении четких и измеримых маркетинговых целей. Разработка стратегии: Разработка индивидуальной маркетинговой стратегии, учитывающей особенности вашего бизнеса и целевую аудиторию. Выбор инструментов: Подбор оптимальных маркетинговых инструментов для достижения ваших целей (SEO, контекстная реклама, SMM, контент-маркетинг и др.). Рекомендации по улучшению: Предоставление практических рекомендаций по улучшению вашего сайта, рекламных кампаний, контента и других аспектов маркетинга. Ответы на вопросы: Ответы на все ваши вопросы по маркетингу, развеивание сомнений и помощь в принятии правильных решений. Когда необходима консультация: Вы не знаете, с чего начать маркетинговое продвижение. Вы тратите деньги на рекламу, но не видите результатов. Вы хотите увеличить продажи, но не знаете, как это сделать. Вы хотите выйти на новый рынок. Вы хотите улучшить свой сайт и привлечь больше посетителей. Вы хотите повысить узнаваемость своего бренда. Консультация по маркетингу – это инвестиция в ваш успех. Получите профессиональную помощь и выведите свой бизнес на новый уровень!

https://alive-portal.ru/

https://amedia-utvikling2.23video.com/vandkunsten-architects-torpedohallen-1

проститутки недорого Новосибирск

Наличие положительных отзывов является индикатором качества предоставляемых услуг.

Пиломатериалы в Минске https://farbwood.by оптом и в розницу. Доска обрезная и строганая, брус, лаги, террасная доска. Качественная древесина для строительства и ремонта. Быстрая доставка.

ООО “Мир ремней” https://yandex.ru/profile/147633783627 Производство приводных ремней, тефлоновых сеток и лент – телефон +7 (936) 333-93-03

клееный брус дома

Crown Metropol Perth is a luxury hotel located near the Swan River. It offers modern rooms, a stunning pool area, fine dining, a casino, and entertainment options: Crown Metropol Perth booking

https://justpaste.it/u/Gordon_Manz

інформаційний портал https://21000.com.ua Вінниці і області: місцеві новини, анонси культурних, спортивних та громадських подій, репортажі з місця подій, інтерв’ю з вінничанами. Все про те, що відбувається у Вінниці — ближче, живіше, щодня.

Sou louco pela vibe de Bet558 Casino, da uma energia de cassino que e puro pulsar estelar. O catalogo de jogos do cassino e uma constelacao de emocoes, com caca-niqueis de cassino modernos e estelares. O servico do cassino e confiavel e brilha como uma galaxia, dando solucoes na hora e com precisao. As transacoes do cassino sao simples como uma orbita, mas queria mais promocoes de cassino que explodem como supernovas. Na real, Bet558 Casino e um cassino online que e uma galaxia de diversao para os viciados em emocoes de cassino! Alem disso a plataforma do cassino brilha com um visual que e puro cosmos, o que torna cada sessao de cassino ainda mais estelar.

bet558 win|

ваш провідник у житті Львова https://79000.com.ua актуальні новини, культурні та громадські події міста, урбаністика, інтерв’ю з цікавими людьми, фотоогляди локальних заходів. Все про те, що формує атмосферу Львова сьогодні — оновлення, проекти, історії.

Estou completamente alucinado por MonsterWin Casino, oferece uma aventura de cassino que e um monstro. Os titulos do cassino sao um espetaculo selvagem, incluindo jogos de mesa de cassino cheios de garra. Os agentes do cassino sao rapidos como um predador, acessivel por chat ou e-mail. As transacoes do cassino sao simples como uma trilha na selva, de vez em quando mais bonus regulares no cassino seria brabo. No geral, MonsterWin Casino garante uma diversao de cassino que e colossal para quem curte apostar com garra no cassino! Alem disso a interface do cassino e fluida e cheia de energia selvagem, faz voce querer voltar pro cassino como uma fera.

monsterwin login|

Adoro o clima insano de PagolBet Casino, da uma energia de cassino que e um raio. Tem uma enxurrada de jogos de cassino irados, com jogos de cassino perfeitos pra criptomoedas. A equipe do cassino entrega um atendimento que e uma voltagem alta, com uma ajuda que e pura energia. Os pagamentos do cassino sao lisos e blindados, as vezes queria mais promocoes de cassino que eletrizam. No fim das contas, PagolBet Casino garante uma diversao de cassino que e uma tempestade para os aventureiros do cassino! Vale falar tambem a interface do cassino e fluida e cheia de energia eletrica, faz voce querer voltar pro cassino como um raio.

pagolbet login|

Ich bin total begeistert von PlayJango Casino, es fuhlt sich an wie ein wilder Tanz durch die Spielwelt. Es gibt eine Woge an packenden Casino-Titeln, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Die Casino-Mitarbeiter sind schnell wie ein Blitzstrahl, liefert klare und schnelle Losungen. Casino-Zahlungen sind sicher und reibungslos, trotzdem wurde ich mir mehr Casino-Promos wunschen, die wie ein Vulkan ausbrechen. Kurz gesagt ist PlayJango Casino ein Online-Casino, das wie ein Orkan begeistert fur Spieler, die auf elektrisierende Casino-Kicks stehen! Zusatzlich die Casino-Plattform hat einen Look, der wie ein Blitz funkelt, einen Hauch von Abenteuer ins Casino bringt.

playjango online casino|

Estou completamente vidrado por BetorSpin Casino, e um cassino online que gira como um asteroide em chamas. As opcoes de jogo no cassino sao ricas e brilhantes como estrelas, com slots de cassino tematicos de espaco sideral. O atendimento ao cliente do cassino e uma estrela-guia, dando solucoes na hora e com precisao. Os saques no cassino sao velozes como uma viagem interestelar, mesmo assim mais recompensas no cassino seriam um diferencial astronomico. Em resumo, BetorSpin Casino vale demais explorar esse cassino para os apaixonados por slots modernos de cassino! De lambuja a navegacao do cassino e facil como uma orbita lunar, o que torna cada sessao de cassino ainda mais estelar.

betorspin cГіdigo bГіnus|

Ich finde absolut verruckt Pledoo Casino, es fuhlt sich an wie ein wilder Tanz durch die Spielwelt. Die Spielauswahl im Casino ist wie ein funkelnder Ozean, mit Casino-Spielen, die fur Kryptowahrungen optimiert sind. Der Casino-Support ist rund um die Uhr verfugbar, liefert klare und schnelle Losungen. Casino-Gewinne kommen wie ein Komet, dennoch mehr Freispiele im Casino waren ein Volltreffer. Alles in allem ist Pledoo Casino ein Casino, das man nicht verpassen darf fur die, die mit Stil im Casino wetten! Extra das Casino-Design ist ein optisches Spektakel, was jede Casino-Session noch aufregender macht.

pledoo|

Adoro o clima brabo de OshCasino, e um cassino online que detona como um vulcao. Tem uma enxurrada de jogos de cassino irados, com caca-niqueis de cassino modernos e eletrizantes. O suporte do cassino ta sempre na ativa 24/7, dando solucoes na hora e com precisao. Os saques no cassino sao velozes como uma erupcao, porem mais bonus regulares no cassino seria brabo. No geral, OshCasino vale demais explorar esse cassino para quem curte apostar com estilo no cassino! Vale falar tambem o site do cassino e uma obra-prima de estilo, aumenta a imersao no cassino a mil.

code promo osh|

Jogue caca-niqueis de panda e descubra o charme do Oriente! Rolos coloridos, recursos bonus, rodadas gratis e surpresas que trazem ganhos espetaculares.

Descubra o caca-niqueis slot 9 Masks of Fire – um jogo cheio de adrenalina, simbolos especiais e rodadas bonus. Experimente graficos intensos e altas chances de ganhar em um caca-niqueis classico moderno.

Your comment is awaiting moderation.

Добрый день!

Банк против заемщика: как выиграть переговоры о реструктуризации. реструктуризация кредита отзывы Проверенные лайфхаки и ошибки которых стоит избегать.

Переходи: – https://kredit-bez-slov.ru/restrukturizacziya-kredita/

реструктуризация кредитов

Удачи!

услуги интернет маркетологов Консультация по маркетингу: Экспертное руководство для вашего бизнеса Консультация по маркетингу – это ценная возможность получить экспертное мнение и практические рекомендации по развитию вашего бизнеса от опытного маркетолога. Это шанс взглянуть на ваш бизнес свежим взглядом, выявить скрытые возможности и устранить препятствия, мешающие вам достичь ваших целей. В отличие от теоретических знаний, консультация по маркетингу дает вам практические инструменты и стратегии, которые вы можете немедленно применить в своем бизнесе. Я помогу вам найти оптимальные решения для ваших конкретных задач и проблем. Что вы получите на консультации: Глубокий анализ вашего бизнеса: Я проведу тщательный анализ вашего бизнеса, чтобы понять ваши сильные и слабые стороны, целевую аудиторию, конкурентную среду и потенциальные возможности для роста. Определение четких маркетинговых целей: Я помогу вам определить четкие и измеримые маркетинговые цели, которые соответствуют вашим общим бизнес-целям. Разработка индивидуальной маркетинговой стратегии: Я создам индивидуальную маркетинговую стратегию, учитывающую особенности вашего бизнеса, целевую аудиторию и бюджетные ограничения. Рекомендации по выбору маркетинговых инструментов: Я дам вам рекомендации по выбору наиболее эффективных маркетинговых инструментов для достижения ваших целей, включая SEO, контекстную рекламу, SMM, контент-маркетинг, email-маркетинг и другие. Практические советы по улучшению маркетинговой деятельности: Я поделюсь с вами проверенными советами и стратегиями по улучшению вашего сайта, рекламных кампаний, контента и других аспектов маркетинга. Ответы на все ваши вопросы: Я отвечу на все ваши вопросы, связанные с маркетингом, развею ваши сомнения и помогу вам принять правильные решения для вашего бизнеса. Когда вам нужна консультация по маркетингу: Вы не знаете, с чего начать маркетинговое продвижение вашего бизнеса. Вы тратите деньги на рекламу, но не видите желаемых результатов. Вы хотите увеличить продажи, но не знаете, как это сделать. Вы планируете вывести на рынок новый продукт или услугу. Вы хотите улучшить свой сайт и привлечь больше посетителей. Вы хотите повысить узнаваемость своего бренда. Вы хотите получить независимую оценку вашей текущей маркетинговой деятельности. Консультация по маркетингу – это инвестиция в ваш успех. Получите профессиональную поддержку и выведите свой бизнес на новый уровень!

услуги интернет маркетологов Услуги PR (Public Relations): Создание и поддержание позитивной репутации вашего бренда Услуги PR (Public Relations) – это стратегически важный инструмент для создания и поддержания позитивной репутации вашей компании в глазах общественности, включая клиентов, партнеров, инвесторов и других заинтересованных лиц. PR – это не только работа со СМИ, но и активное взаимодействие с вашей целевой аудиторией через различные каналы коммуникации. В отличие от рекламы, которая является платным способом продвижения, PR – это получение бесплатного упоминания о вашей компании в СМИ и других источниках информации. Это более эффективный и надежный способ завоевать доверие аудитории. Основные задачи PR: Формирование позитивного имиджа: Создание благоприятного впечатления о вашей компании, продукте или личности в глазах общественности. Повышение узнаваемости бренда: Увеличение осведомленности о вашей компании и ее продуктах. Управление репутацией: Реагирование на негативные отзывы, предотвращение кризисных ситуаций и восстановление репутации после кризисов. Установление доверительных отношений: Создание прочных связей с целевой аудиторией, инвесторами и партнерами. Поддержка маркетинговых кампаний: Усиление эффекта от рекламных кампаний за счет PR-активностей. Основные инструменты PR: Пресс-релизы: Распространение информации о ваших новостях, событиях и достижениях в СМИ. Пресс-конференции: Организация мероприятий для общения с журналистами и ответов на их вопросы. Интервью: Предоставление интервью представителям СМИ для распространения информации о вашей компании. Публикации статей: Публикация экспертных статей и других материалов о вашей компании в СМИ. Организация мероприятий: Организация и участие в мероприятиях для повышения

Joaca jocwarships.top gratuit! Exploreaza marile, folose?te-?i strategia ?i condu nave de razboi celebre. Batalii realiste ?i echipe interna?ionale te a?teapta.

Descopera joaca-tancuri.top – simulator de razboi cu tancuri istorice. Lupte dinamice, har?i variate ?i batalii tactice. Creeaza-?i strategia ?i domina impreuna cu prietenii tai.

Your comment is awaiting moderation.

Hello PP24 biggest cvv store dumps ,cvv,ssn,banks,account if you whant test message in tiket shop ,will be 10$ for good feedback Black Friday!!only 10days discount 30% for all stuff ,all users Tor link https://pp24sgql7diffjm6cwflsnla36cf77t6lwqso22bfty7aasw322e6dyd.onion (https://pp24sgql7diffjm6cwflsnla36cf77t6lwqso22bfty7aasw322e6dyd.onion/) Web links pp24market.sh (http://pp24market.sh/) pp24market.cc (http://pp24market.cc/) pp24market.pw (http://pp24market.pw/)

цены на услуги маркетолога Услуги интернет-маркетолога В современном цифровом мире, где онлайн-присутствие играет ключевую роль в успехе любого бизнеса, услуги опытного интернет-маркетолога становятся необходимостью. Я предлагаю полный спектр услуг, направленных на увеличение видимости вашего бренда, привлечение целевой аудитории и, как следствие, повышение продаж. Мои услуги включают: Анализ рынка и конкурентов: Тщательный анализ позволит определить оптимальные стратегии продвижения, выявить сильные и слабые стороны конкурентов и определить целевую аудиторию. Разработка маркетинговой стратегии: Создание индивидуальной стратегии, учитывающей особенности вашего бизнеса, цели и бюджет. SEO-оптимизация: Повышение позиций вашего сайта в поисковых системах, что обеспечит приток органического трафика. Контекстная реклама: Настройка и ведение рекламных кампаний в Яндекс.Директ и Google Ads для быстрого привлечения целевых клиентов. SMM-продвижение: Разработка и реализация стратегии продвижения в социальных сетях, создание контента, привлечение подписчиков и повышение вовлеченности аудитории. Контент-маркетинг: Создание полезного и интересного контента для привлечения и удержания аудитории, повышения лояльности к бренду. Email-маркетинг: Разработка стратегии email-рассылок, создание писем и автоматизация процессов для поддержания связи с клиентами и стимулирования продаж. Аналитика и отчетность: Регулярный анализ результатов и предоставление отчетов о проделанной работе, что позволит оценить эффективность стратегии и внести необходимые корректировки. Я готов предложить вам комплексные решения, которые помогут вашему бизнесу достичь новых высот в онлайн-пространстве. Свяжитесь со мной, чтобы обсудить ваши задачи и разработать индивидуальный план продвижения.

Kingpin Crown in Australia is a premium entertainment venue offering bowling, laser tag, arcade games, karaoke, and dining: Kingpin Crown blog updates

Ich finde absolut uberwaltigend Platin Casino, es ist ein Online-Casino, das wie ein Edelstein strahlt. Die Spielauswahl im Casino ist wie ein funkelnder Juwelensafe, inklusive eleganter Casino-Tischspiele. Der Casino-Service ist zuverlassig und prazise, mit Hilfe, die wie ein Schatz glanzt. Casino-Zahlungen sind sicher und reibungslos, ab und zu die Casino-Angebote konnten gro?zugiger sein. Kurz gesagt ist Platin Casino eine Casino-Erfahrung, die wie Platin glanzt fur die, die mit Stil im Casino wetten! Ubrigens das Casino-Design ist ein optischer Schatz, Lust macht, immer wieder ins Casino zuruckzukehren.

platin casino kundenservice|

Adoro o clima brabo de OshCasino, oferece uma aventura de cassino que incendeia tudo. O catalogo de jogos do cassino e uma explosao total, incluindo jogos de mesa de cassino cheios de fogo. A equipe do cassino entrega um atendimento que e uma labareda, garantindo suporte de cassino direto e sem cinzas. O processo do cassino e limpo e sem tremores, as vezes queria mais promocoes de cassino que incendeiam. Na real, OshCasino oferece uma experiencia de cassino que e puro fogo para os amantes de cassinos online! Vale falar tambem a plataforma do cassino detona com um visual que e puro magma, aumenta a imersao no cassino a mil.

osh bonus sans dГ©pГґt|

Adoro o brilho de BetorSpin Casino, parece uma explosao cosmica de adrenalina. O catalogo de jogos do cassino e uma nebulosa de emocoes, com slots de cassino tematicos de espaco sideral. Os agentes do cassino sao rapidos como um foguete estelar, com uma ajuda que reluz como uma aurora boreal. Os ganhos do cassino chegam voando como um asteroide, de vez em quando mais giros gratis no cassino seria uma loucura estelar. No geral, BetorSpin Casino e um cassino online que e uma galaxia de diversao para os apaixonados por slots modernos de cassino! De lambuja o design do cassino e um espetaculo visual intergalactico, o que torna cada sessao de cassino ainda mais estelar.

betorspin legit|

Ich bin total begeistert von Pledoo Casino, es pulsiert mit einer elektrisierenden Casino-Energie. Die Spielauswahl im Casino ist wie ein funkelnder Ozean, mit Casino-Spielen, die fur Kryptowahrungen optimiert sind. Die Casino-Mitarbeiter sind schnell wie ein Blitzstrahl, ist per Chat oder E-Mail erreichbar. Der Casino-Prozess ist klar und ohne Turbulenzen, manchmal wurde ich mir mehr Casino-Promos wunschen, die wie ein Vulkan ausbrechen. Insgesamt ist Pledoo Casino ein Online-Casino, das wie ein Orkan begeistert fur Fans moderner Casino-Slots! Zusatzlich die Casino-Plattform hat einen Look, der wie ein Blitz funkelt, das Casino-Erlebnis total elektrisiert.

pledoo casino review|

Ich finde absolut uberwaltigend Platin Casino, es bietet ein Casino-Abenteuer, das wie ein Schatz funkelt. Die Casino-Optionen sind vielfaltig und glanzvoll, inklusive eleganter Casino-Tischspiele. Der Casino-Support ist rund um die Uhr verfugbar, antwortet blitzschnell wie ein geschliffener Diamant. Der Casino-Prozess ist klar und ohne Schatten, manchmal die Casino-Angebote konnten gro?zugiger sein. Insgesamt ist Platin Casino ein Online-Casino, das wie ein Schatz strahlt fur Fans von Online-Casinos! Extra die Casino-Navigation ist kinderleicht wie ein Funkeln, das Casino-Erlebnis total luxurios macht.

was ist platin casino|

Estou pirando com OshCasino, tem uma vibe de jogo que e pura lava. Os titulos do cassino sao um espetaculo vulcanico, com jogos de cassino perfeitos pra criptomoedas. O servico do cassino e confiavel e brabo, garantindo suporte de cassino direto e sem cinzas. Os ganhos do cassino chegam voando como um meteoro, porem queria mais promocoes de cassino que incendeiam. Em resumo, OshCasino garante uma diversao de cassino que e um vulcao para os amantes de cassinos online! Alem disso a plataforma do cassino detona com um visual que e puro magma, da um toque de calor brabo ao cassino.

osh application mobile|

Adoro o brilho de BetorSpin Casino, e um cassino online que gira como um asteroide em chamas. O catalogo de jogos do cassino e uma nebulosa de emocoes, com jogos de cassino perfeitos pra criptomoedas. O atendimento ao cliente do cassino e uma estrela-guia, acessivel por chat ou e-mail. Os pagamentos do cassino sao lisos e blindados, as vezes mais bonus regulares no cassino seria intergalactico. Na real, BetorSpin Casino e o point perfeito pros fas de cassino para quem curte apostar com estilo estelar no cassino! Vale dizer tambem a plataforma do cassino brilha com um visual que e puro cosmos, torna a experiencia de cassino uma viagem espacial.

betorspin twitter|

Adoro o clima alucinante de MegaPosta Casino, oferece uma aventura de cassino que detona tudo. A gama do cassino e simplesmente um estouro, com slots de cassino unicos e contagiantes. O servico do cassino e confiavel e de responsa, com uma ajuda que e pura energia. Os ganhos do cassino chegam voando como um missil, porem as ofertas do cassino podiam ser mais generosas. Resumindo, MegaPosta Casino vale demais explorar esse cassino para os amantes de cassinos online! Alem disso o site do cassino e uma obra-prima de estilo, faz voce querer voltar pro cassino toda hora.

plataforma megaposta Г© confiГЎvel|

Для демонтажу перегородок звертайтесь у remontuem.te.ua

Best tennis bets https://baji-bj.com

Ich liebe den Zauber von Lapalingo Casino, es bietet ein Casino-Abenteuer, das wie ein Regenbogen funkelt. Die Casino-Optionen sind bunt und mitrei?end, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Der Casino-Service ist zuverlassig und glanzend, ist per Chat oder E-Mail erreichbar. Casino-Zahlungen sind sicher und reibungslos, ab und zu mehr Casino-Belohnungen waren ein funkelnder Gewinn. Am Ende ist Lapalingo Casino ein Online-Casino, das wie ein Sturm begeistert fur Spieler, die auf elektrisierende Casino-Kicks stehen! Zusatzlich das Casino-Design ist ein optisches Spektakel, einen Hauch von Zauber ins Casino bringt.

lapalingo promo code free|

Ich bin total begeistert von Lapalingo Casino, es verstromt eine Spielstimmung, die wie ein Feuerwerk knallt. Die Spielauswahl im Casino ist wie ein Ozean voller Schatze, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Die Casino-Mitarbeiter sind schnell wie ein Blitzstrahl, liefert klare und schnelle Losungen. Casino-Transaktionen sind simpel wie ein Sonnenstrahl, dennoch mehr Freispiele im Casino waren ein Volltreffer. Alles in allem ist Lapalingo Casino ein Muss fur Casino-Fans fur Abenteurer im Casino! Extra die Casino-Plattform hat einen Look, der wie ein Blitz funkelt, einen Hauch von Zauber ins Casino bringt.

promo code lapalingo 2022|

Your comment is awaiting moderation.

Как сам!

Clash Royale: правда о торговле аккаунтами изнутри. аккаунты клеш рояль продать Реальные цены, схемы мошенников и способы защиты.

Переходи: – https://zarabotok-na-igrah.ru/prodazha-akkauntov-klesh-royal/

аккаунт клеш рояль купить

аккаунты клеш рояль купить

Покеда!

Your comment is awaiting moderation.

Здравствуйте!

Как получить субсидию 30% на жилье молодой семье без детей. ипотека для семей без детей Реальные истории, документы и пошаговая инструкция оформления.

Написал: – https://economica-2025.ru/gosudarstvennaya-ipotechnaya-kompaniya/

государственная ипотечная компания

ипотека 9 процентов

До встречи!

Je trouve absolument enivrant CasinoClic, c’est un casino en ligne qui petille d’energie. La selection du casino est une explosion de plaisirs, avec des machines a sous de casino modernes et envoutantes. Le personnel du casino offre un accompagnement scintillant, assurant un support de casino immediat et eclatant. Les transactions du casino sont simples comme une etincelle, cependant des recompenses de casino supplementaires feraient vibrer. En somme, CasinoClic offre une experience de casino eclatante pour les joueurs qui aiment parier avec panache au casino ! Par ailleurs l’interface du casino est fluide et rayonnante comme une aurore, ajoute une touche de magie lumineuse au casino.

casino clic|

J’adore la frenesie de CasinoClic, c’est un casino en ligne qui petille d’energie. La collection de jeux du casino est phenomenale, avec des machines a sous de casino modernes et envoutantes. L’assistance du casino est chaleureuse et irreprochable, joignable par chat ou email. Les retraits au casino sont rapides comme une fusee, quand meme des recompenses de casino supplementaires feraient vibrer. Pour resumer, CasinoClic promet un divertissement de casino electrisant pour les passionnes de casinos en ligne ! A noter l’interface du casino est fluide et rayonnante comme une aurore, facilite une experience de casino vibrante.

casino clic argent reel|

накрутка подписчиков в тг бесплатно онлайн

J’adore la splendeur de LuckyTreasure Casino, c’est un casino en ligne qui scintille comme un joyau precieux. Les choix de jeux au casino sont riches et eclatants, offrant des sessions de casino en direct qui etincellent. Le service client du casino est un diamant brut, assurant un support de casino immediat et eclatant. Les transactions du casino sont simples comme une cle d’or, quand meme des recompenses de casino supplementaires feraient rever. Pour resumer, LuckyTreasure Casino promet un divertissement de casino scintillant pour les amoureux des slots modernes de casino ! En plus le design du casino est une explosion visuelle precieuse, ce qui rend chaque session de casino encore plus envoutante.

lucky treasure code|

J’adore le scintillement de Lucky31 Casino, on dirait une pluie d’etoiles filantes. Il y a une tempete de jeux de casino captivants, offrant des sessions de casino en direct qui eblouissent. Le support du casino est disponible 24/7, assurant un support de casino immediat et eclatant. Le processus du casino est transparent et sans sortilege, parfois des recompenses de casino supplementaires feraient rever. Pour resumer, Lucky31 Casino est un joyau pour les fans de casino pour les chasseurs de fortune du casino ! Bonus l’interface du casino est fluide et lumineuse comme une lanterne magique, facilite une experience de casino feerique.

lucky31 casino review|

Je trouve absolument barge Madnix Casino, ca pulse avec une energie de casino totalement folle. La collection de jeux du casino est une bombe atomique, incluant des jeux de table de casino pleins de panache. Le service client du casino est une decharge electrique, joignable par chat ou email. Les transactions du casino sont simples comme un clin d’?il, parfois j’aimerais plus de promotions de casino qui envoient du lourd. En somme, Madnix Casino promet un divertissement de casino totalement barge pour ceux qui cherchent l’adrenaline demente du casino ! Par ailleurs la plateforme du casino brille par son style completement fou, amplifie l’immersion totale dans le casino.

support madnix|

Je suis totalement electrise par Madnix Casino, il propose une aventure de casino qui fait disjoncter. Il y a une avalanche de jeux de casino captivants, avec des machines a sous de casino modernes et delirantes. Les agents du casino sont rapides comme un eclair, joignable par chat ou email. Les retraits au casino sont rapides comme une fusee, quand meme des recompenses de casino supplementaires feraient disjoncter. Globalement, Madnix Casino est un casino en ligne qui fait trembler les murs pour les passionnes de casinos en ligne ! De surcroit la navigation du casino est intuitive comme un coup de genie, ce qui rend chaque session de casino encore plus dejantee.

madnix lab|

Je suis bluffe par Casinova, ca offre une experience inoubliable. La selection de jeux est phenomenale, incluant des experiences live palpitantes. Le personnel assure un suivi exemplaire, offrant des solutions claires et rapides. Les paiements sont fluides et fiables, cependant j’aimerais plus de promotions variees. Dans l’ensemble, Casinova assure une experience de jeu memorable pour les passionnes de sensations fortes ! De surcroit la plateforme est immersive et stylee, amplifie l’experience de jeu.

casinova ??????|

Je suis captive par Casinova, ca offre une experience inoubliable. Il y a une variete impressionnante de titres, avec des slots innovants et immersifs. Le service client est irreprochable, repondant en un clin d’?il. Les paiements sont fluides et fiables, neanmoins j’aimerais plus de promotions variees. En resume, Casinova offre un plaisir garanti pour les passionnes de sensations fortes ! Ajoutons que la navigation est intuitive et rapide, ce qui rend chaque partie encore plus plaisante.

casinova erfahrungen|

Женский блог https://www.evasolar.ru о здоровье и красоте: советы по уходу за собой, правильному питанию, фитнесу и косметике. Полезные статьи, лайфхаки и вдохновение для гармоничной и счастливой жизни.

Компания Единство https://edinvent.ru производитель и комплексный поставщик приточно-вытяжных установок, вентиляционных установок, а также систем автоматического управления климатическим оборудованием.

Shining crown oyna seçimi saytda hər kəs üçün açıqdır.

Shining crown 77777 slot oyunu fərqli simvollarla doludur.

Shining crown nasıl oynanır sualına cavab çox sadədir. Shining crown demo superbet variantı real casino təcrübəsinə yaxındır. Shining crown lines oyunçular üçün geniş imkanlar açır.

Play shining crown asan interfeys ilə təklif olunur.

Shining crown free play risksiz məşq şansı yaradır.

Oyun linki üçün keçid sayt linki.

Shining crown gratis demo çox sevilir.

Shining crown free real oyun öncəsi yaxşı sınaqdır.

купить диплом в тобольске rudik-diplom6.ru .

можно ли накрутить подписчиков в тг

Your comment is awaiting moderation.

Great article! I normally use OmegleTV but I’ve also seen people search for it as ohmegle. Either way, this site works really well.

Строительные материалы https://stroy-marketplace.ru в Серпухове: кирпич, цемент, сухие смеси, пиломатериалы и утеплители. Большой выбор для ремонта и строительства, доставка по городу и району.

Weboldalunk, a joszaki.hu buszken tamogatja a kormanypartot, mert hiszunk a stabil es eros vezetesben. Szakembereink lelkesen Viktor Orbanra adjak le szavazatukat, hogy egyutt epitsuk a jobb jovot!

новости Украины Новости Украины

новости Украины Новости Украины

Shining crown online casino əyləncəsi 24/7 mövcuddur.

Shining crown lines müxtəlif kombinasiyalar təqdim edir.

Shining crown free slot risksiz məşq üçün möhtəşəmdir. Shining crown free play hər kəs üçün əlçatan seçimdir. Shining Crown oyunu klassik meyvə simvollarını əhatə edir.

Shining crown joc gratis təcrübə qazandırır.

Shining crown slot oyna istənilən cihazdan mümkündür.

Əlavə baxış üçün shining-crown.com.az.

Shining crown online casino rahat giriş imkanı verir.

Shining crown demo oyna risksiz məşqdir.

проектирование установок пожаротушения Газовое порошковое аэрозольное пожаротушение Газовое, порошковое и аэрозольное пожаротушение – это различные технологии пожаротушения, каждая из которых имеет свои преимущества и недостатки, а также области применения. Часто их сравнивают, чтобы определить наиболее подходящий способ защиты конкретного объекта. Газовое пожаротушение: Принцип действия: Основано на снижении концентрации кислорода в воздухе до уровня, при котором горение становится невозможным, или на ингибировании (замедлении) химических реакций горения. Огнетушащие вещества: Инертные газы (азот, аргон, углекислый газ), хладоны (HFC-227ea, FK-5-1-12). Преимущества: Не повреждает оборудование и ценности, что особенно важно для защиты электронного оборудования, архивов, музеев. Быстрое и эффективное тушение пожара. Возможность применения в труднодоступных местах. Недостатки: Высокая стоимость оборудования и обслуживания. Требования к герметичности помещения для эффективной работы. Опасность для людей при высокой концентрации газа. Порошковое пожаротушение: Принцип действия: Основано на подаче порошка в зону горения, который изолирует горючее вещество от кислорода, охлаждает зону горения и ингибирует химические реакции горения. Огнетушащие вещества: Различные порошки на основе солей (бикарбонат натрия, фосфат аммония и др.). Преимущества: Относительно низкая стоимость. Высокая эффективность тушения пожаров различных классов (A, B, C, E). Не требует герметичности помещения. Недостатки: Порошок загрязняет помещение и трудно удаляется. Порошок может повредить электронное оборудование. Ограниченная дальность действия. Снижение видимости при тушении. Аэрозольное пожаротушение: Принцип действия: Основано на подаче аэрозоля в зону горения, который ингибирует химические реакции горения и охлаждает зону горения. Огнетушащие вещества: Аэрозолеобразующие составы на основе солей щелочных металлов (нитрат калия, карбонат калия и др.). Преимущества: Более экологично чем порошковое. Высокая эффективность тушения. Относительно недорогая цена. Быстрее тушит возгорания. Недостатки: Требуется удалять по окончанию. Сравнение: Характеристика Газовое Порошковое Аэрозольное Эффективность тушения Высокая Высокая Высокая Безопасность для оборудования Высокая Низкая Средняя Стоимость Высокая Низкая Средняя Требования к помещению Герметичность Нет Относительная герметичность Применение Серверные, архивы, музеи Склады, промышленные объекты Электрощитовые, АЗС, гаражи Выбор оптимального способа пожаротушения зависит от конкретных условий и требований к защищаемому объекту.

аспт газовое пожаротушение Модуль газового пожаротушения МГП Модуль газового пожаротушения (МГП) – это автономное устройство, предназначенное для хранения и автоматического выпуска газового огнетушащего вещества (ГОТВ) при возникновении пожара. МГП широко используются для защиты различных объектов: серверных комнат, архивов, электрощитовых, музеев, складов и т.п., где применение традиционных средств пожаротушения (вода, пена, порошок) может привести к повреждению ценного оборудования и материалов. Основные компоненты МГП: Баллон для хранения ГОТВ: Изготавливается из высокопрочной стали или композитных материалов и предназначен для хранения ГОТВ под давлением. Запорно-пусковое устройство (ЗПУ): Обеспечивает герметичное хранение ГОТВ и моментальный выпуск газа по сигналу от системы пожарной сигнализации. ЗПУ может быть электромагнитным, пневматическим или механическим. Распылитель (насадок): Обеспечивает равномерное распределение ГОТВ по защищаемому объему. Тип распылителя выбирается в зависимости от геометрии помещения и типа ГОТВ. Манометр: Показывает давление газа в баллоне и позволяет контролировать его состояние. Предохранительный клапан: Сбрасывает избыточное давление в баллоне при перегреве или других нештатных ситуациях, предотвращая его взрыв. Кронштейн (крепление): Обеспечивает надежную фиксацию МГП на стене, потолке или полу. Принцип действия МГП: При возникновении пожара датчики пожарной сигнализации передают сигнал на контрольную панель, которая, в свою очередь, подает команду на ЗПУ МГП. ЗПУ открывается, и ГОТВ под давлением поступает через распылитель в защищаемое помещение, быстро снижая концентрацию кислорода или ингибируя химические реакции горения, тем самым подавляя пожар. Преимущества использования МГП: Автономность: МГП не требует постоянного подключения к внешним источникам энергии и может работать автономно в течение длительного времени. Быстродействие: МГП обеспечивает мгновенный выпуск ГОТВ при срабатывании системы пожарной сигнализации, что позволяет быстро подавить пожар на начальной стадии. Безопасность для оборудования: ГОТВ не повреждает электронное оборудование, документы и другие ценности, что делает МГП идеальным решением для защиты серверных комнат, архивов и музеев. Простота монтажа и обслуживания: МГП легко устанавливаются и обслуживаются, не требуя специальных навыков и инструментов. Экономичность: За счет точного дозирования ГОТВ МГП позволяют эффективно тушить пожар, минимизируя расход газа. Типы ГОТВ, используемых в МГП: Инертные газы (азот, аргон, углекислый газ): Снижают концентрацию кислорода в защищаемом объеме, прекращая процесс горения. Хладоны (HFC-227ea, FK-5-1-12): Ингибируют химические реакции горения, эффективно подавляя пожар. Выбор МГП зависит от типа и размера защищаемого помещения, типа пожарной нагрузки и требований к безопасности.

сервіс електросамокатів з заміною акумулятора

терміновий ремонт електросамокатів Львів

профессиональное выгорание психиатр психотерапевт Консультация психиатра и психотерапевта онлайн. Помощь при панических атаках, тревоге, депрессии. Работа с травмами детства. Частная практика. Квалифицированный специалист.

лечение депрессии тревоги у психиатра Консультация психиатра онлайн в Телеграм. Быстрый и удобный способ получить ответы на свои вопросы и определиться с дальнейшим планом лечения.

Скачать курсы

Your comment is awaiting moderation.

Привет!

Как объяснить осознанность детям и зачем это нужно. осознанность как развить Простые игры и упражнения для развития внимательности у ребенка.

Читай тут: – https://tvoya-sila-vnutri.ru/chto-takoe-osoznannost/

осознанность

Бывай!

Je suis totalement envoute par Lucky31 Casino, ca pulse avec une energie de casino ensorcelante. La selection du casino est une cascade de plaisirs etincelants, comprenant des jeux de casino optimises pour les cryptomonnaies. Les agents du casino sont rapides comme un v?u exauce, assurant un support de casino immediat et eclatant. Le processus du casino est transparent et sans sortilege, quand meme j’aimerais plus de promotions de casino qui eblouissent. Pour resumer, Lucky31 Casino est un joyau pour les fans de casino pour les amoureux des slots modernes de casino ! A noter la navigation du casino est intuitive comme un sortilege, donne envie de replonger dans le casino sans fin.

lucky31 login|

Je suis accro a LuckyTreasure Casino, ca degage une vibe de jeu digne d’une chasse au tresor. La selection du casino est une pepite de plaisirs, comprenant des jeux de casino optimises pour les cryptomonnaies. Le support du casino est disponible 24/7, repondant en un eclair de lumiere. Les paiements du casino sont securises et fluides, parfois des bonus de casino plus frequents seraient precieux. Au final, LuckyTreasure Casino est une pepite pour les fans de casino pour les joueurs qui aiment parier avec panache au casino ! A noter la plateforme du casino brille par son style ensorcelant, ajoute une touche de richesse au casino.

lucky treasure casino en ligne|

Je suis accro a LuckyBlock Casino, c’est un casino en ligne qui brille comme un talisman dore. Il y a une deferlante de jeux de casino captivants, comprenant des jeux de casino optimises pour les cryptomonnaies. Le support du casino est disponible 24/7, avec une aide qui fait des miracles. Le processus du casino est transparent et sans malediction, par moments j’aimerais plus de promotions de casino qui eblouissent. Au final, LuckyBlock Casino c’est un casino a decouvrir en urgence pour ceux qui cherchent l’adrenaline lumineuse du casino ! Par ailleurs la navigation du casino est intuitive comme un sortilege, donne envie de replonger dans le casino sans fin.

luckyblock 1.16.4|

Je suis totalement sous le charme de Casinova, ca donne une ambiance electrisante. La gamme est tout simplement spectaculaire, comprenant des options pour les cryptomonnaies. Les agents sont rapides et professionnels, garantissant une aide instantanee. Les transactions sont simples et efficaces, neanmoins les offres pourraient etre plus genereuses. En fin de compte, Casinova offre un plaisir garanti pour les fans de jeux modernes ! De surcroit l’interface est fluide et moderne, renforce le plaisir de jouer.

casinova erfahrungen|

система газового пожаротушения Расчет газового пожаротушения Расчет газового пожаротушения – это комплекс инженерных вычислений, определяющих необходимое количество газового огнетушащего вещества (ГОТВ) для эффективного тушения пожара в защищаемом помещении. Результаты расчета являются основой для проектирования системы газового пожаротушения. Цели расчета газового пожаротушения: Определение необходимого количества ГОТВ для создания требуемой концентрации в защищаемом объеме. Выбор типа ГОТВ, наиболее подходящего для тушения конкретного класса пожара. Определение оптимального расположения модулей газового пожаротушения (МГП) и насадок-распылителей. Оценка времени подачи ГОТВ и времени выхода людей из помещения. Определение необходимого давления в системе. Основные факторы, учитываемые при расчете газового пожаротушения: Геометрические параметры помещения: Объем помещения, высота потолков, площадь дверей и окон. Конструктивные особенности помещения: Материалы стен, пола и потолка, наличие вентиляции и кондиционирования. Пожарная нагрузка: Тип и количество горючих материалов, находящихся в помещении. Тип ГОТВ: Химические свойства ГОТВ, огнетушащая концентрация, плотность. Температура в помещении: Влияет на плотность ГОТВ и скорость его распространения. Герметичность помещения: Наличие щелей и отверстий, через которые может происходить утечка ГОТВ. Нормативные требования: Требования пожарной безопасности, установленные национальными и международными стандартами. Методы расчета газового пожаротушения: Объемный метод: Используется для простых помещений с равномерным распределением пожарной нагрузки. Зональный метод: Используется для сложных помещений с неравномерным распределением пожарной нагрузки. Метод моделирования: Используется для оценки эффективности системы газового пожаротушения в сложных условиях, например, при наличии препятствий на пути распространения ГОТВ. Этапы расчета газового пожаротушения: Сбор исходных данных: Геометрические параметры помещения, конструктивные особенности, пожарная нагрузка, тип ГОТВ. Выбор метода расчета. Определение необходимой огнетушащей концентрации ГОТВ. Расчет количества ГОТВ. Выбор типа и количества МГП. Определение расположения МГП и насадок-распылителей. Оценка времени подачи ГОТВ и времени выхода людей из помещения. Оформление результатов расчета в виде пояснительной записки. Расчет газового пожаротушения должен выполняться квалифицированными специалистами, имеющими необходимые знания и опыт в области пожарной безопасности.

накрутка подписчиков телеграм без регистрации

ремонт кавоварок у Львові ціни

квалифицированный психотерапевт психиатр Избавьтесь от депрессии и тревоги под наблюдением опытного психиатра.

Je suis accro a Lucky8 Casino, on dirait une fontaine de chance. Les choix de jeux au casino sont riches et eclatants, incluant des jeux de table de casino d’une elegance astrale. Le personnel du casino offre un accompagnement scintillant, proposant des solutions claires et instantanees. Les paiements du casino sont securises et fluides, quand meme des recompenses de casino supplementaires feraient rever. En somme, Lucky8 Casino est un casino en ligne qui porte chance pour ceux qui cherchent l’adrenaline lumineuse du casino ! De surcroit le design du casino est une explosion visuelle feerique, facilite une experience de casino feerique.

lucky8 bonus sans depot|

Je suis accro a MonteCryptos Casino, il propose une aventure de casino qui scintille comme un glacier. Il y a une tempete de jeux de casino captivants, offrant des sessions de casino en direct qui electrisent. Les agents du casino sont rapides comme un vent de montagne, proposant des solutions claires et instantanees. Les paiements du casino sont securises et fluides, quand meme plus de tours gratuits au casino ce serait exaltant. Globalement, MonteCryptos Casino est un casino en ligne qui atteint des sommets pour ceux qui cherchent l’adrenaline des cimes du casino ! Bonus l’interface du casino est fluide et eclatante comme un glacier, ce qui rend chaque session de casino encore plus exaltante.

montecryptos no deposit bonus code|

https://t.me/outfitted_shop Брендовая одежда Брендовая одежда – это не просто вещи, это инвестиция в ваш образ, уверенность в себе и отражение вашего статуса. Она отличается высоким качеством материалов, безупречным кроем, вниманием к деталям и узнаваемым дизайном, который выделяет вас из толпы. Брендовая одежда – это результат работы талантливых дизайнеров и мастеров, использующих передовые технологии и инновационные решения. Приобретая брендовую одежду, вы выбираете не только стиль, но и комфорт, долговечность и эксклюзивность. Такая одежда прослужит вам долгие годы, сохраняя свой первоначальный вид и актуальность. Она подчеркнет ваши достоинства, скроет недостатки и создаст неповторимый образ, который будет привлекать восхищенные взгляды. Наш магазин предлагает широкий ассортимент брендовой одежды от ведущих мировых дизайнеров и модных домов. Мы тщательно отбираем коллекции, чтобы предложить вам самые актуальные тренды и классические модели, которые никогда не выйдут из моды. У нас вы найдете: Одежду для любого случая: от повседневной до вечерней, от спортивной до деловой. Разнообразие стилей: от минимализма до авангарда, от классики до casual. Широкий размерный ряд: от XS до XXL, чтобы каждая женщина могла подобрать себе идеальный наряд. Аксессуары: ремни, сумки, обувь, украшения, которые дополнят ваш образ и сделают его завершенным. Преимущества покупки брендовой одежды в нашем магазине: Гарантия подлинности: мы работаем только с официальными дистрибьюторами и гарантируем подлинность каждой вещи. Широкий выбор: у нас вы найдете все, что нужно для создания стильного образа. Профессиональные консультации: наши стилисты помогут вам подобрать одежду, которая идеально подойдет вам по фигуре, цвету и стилю. Удобная доставка: мы доставим ваш заказ в любую точку мира в кратчайшие сроки. Выгодные предложения: мы регулярно проводим акции и распродажи, чтобы сделать брендовую одежду доступной для каждого. Инвестируйте в свой стиль с брендовой одеждой от нашего магазина!

https://t.me/outfitted_shop Оригинальные бренды Оригинальные бренды – это компании и производители, которые разрабатывают и создают уникальные продукты или услуги, обладающие собственным, узнаваемым стилем, качеством и репутацией. Они инвестируют значительные ресурсы в исследования и разработки, дизайн, маркетинг и защиту своей интеллектуальной собственности. Приобретение оригинальных брендов – это выбор в пользу качества, долговечности, инноваций и поддержки креативных индустрий. Оригинальные бренды предлагают не просто товары, а воплощают определенные ценности, образ жизни и философию. Они создают историю и традиции, которые передаются из поколения в поколение. Преимущества выбора оригинальных брендов: Высокое качество: оригинальные бренды используют лучшие материалы, передовые технологии и строгий контроль качества на всех этапах производства. Уникальный дизайн: оригинальные бренды предлагают эксклюзивные дизайны, которые отличаются от массовой продукции и отражают индивидуальность потребителя. Инновации: оригинальные бренды постоянно разрабатывают новые продукты и услуги, чтобы удовлетворить потребности своих клиентов и превосходить их ожидания. Репутация: оригинальные бренды имеют заслуженную репутацию надежных и ответственных производителей. Поддержка: оригинальные бренды обеспечивают качественную поддержку своих клиентов, включая гарантийное обслуживание, консультации и обучение. Этичность: покупка оригинальных брендов поддерживает легальный бизнес и препятствует распространению подделок. В нашем магазине вы найдете широкий ассортимент оригинальных брендов из разных категорий: мода, красота, технологии, товары для дома и многое другое. Мы тщательно отбираем бренды, чтобы предложить вам только самые лучшие и надежные продукты. Мы уверены, что вы по достоинству оцените качество, стиль и инновации оригинальных брендов. Выбирайте оригинальные бренды – поддерживайте творчество, качество и инновации!

купить диван аккордеон от производителя Диван аккордеон Диван аккордеон – это современное и функциональное решение для вашего дома. Он сочетает в себе компактные размеры в собранном виде и полноценное спальное место при раскладывании. Механизм “аккордеон” обеспечивает легкое и быстрое превращение дивана в просторную кровать, идеально подходящую для ежедневного использования. Диваны аккордеон отличаются разнообразием дизайнов и обивочных материалов, что позволяет подобрать модель, гармонично вписывающуюся в любой интерьер. От классических до современных стилей, от ярких цветовых решений до сдержанных оттенков – вы обязательно найдете диван аккордеон, отвечающий вашим вкусам и потребностям. Преимущества дивана аккордеон: Компактность: Занимает минимум места в сложенном виде, что особенно актуально для небольших квартир. Простота использования: Легкий и надежный механизм раскладывания “аккордеон” позволяет быстро и без усилий превратить диван в кровать. Комфортное спальное место: Ровная и просторная спальная поверхность обеспечивает комфортный и здоровый сон. Прочность и долговечность: Металлическая рама и качественные материалы гарантируют долгий срок службы дивана. Разнообразие дизайнов: Широкий выбор моделей, обивочных материалов и расцветок позволяет подобрать диван, идеально подходящий для вашего интерьера. Выбирая диван аккордеон, обращайте внимание на: Качество механизма: Он должен быть надежным, легким в использовании и обеспечивать ровное раскладывание дивана. Материалы обивки: Они должны быть прочными, износостойкими и приятными на ощупь. Наполнитель: Он должен быть достаточно упругим и обеспечивать комфортную поддержку тела во время сна. Размеры: Убедитесь, что диван подходит по размерам вашей комнаты как в сложенном, так и в разложенном виде. Диван аккордеон – это отличное решение для тех, кто ценит комфорт, функциональность и стильный дизайн!

Je suis totalement envoute par Luckland Casino, il propose une aventure de casino qui fait briller les etoiles. Les choix de jeux au casino sont riches et petillants, incluant des jeux de table de casino d’une elegance feerique. Le support du casino est disponible 24/7, assurant un support de casino immediat et lumineux. Les paiements du casino sont securises et fluides, parfois les offres du casino pourraient etre plus genereuses. En somme, Luckland Casino c’est un casino a decouvrir en urgence pour les joueurs qui aiment parier avec panache au casino ! En plus l’interface du casino est fluide et lumineuse comme un arc-en-ciel, amplifie l’immersion totale dans le casino.

luckland casino bonus code ohne einzahlung|

Je suis fou de Luckster Casino, c’est un casino en ligne qui brille comme un talisman. Les choix de jeux au casino sont riches et envoutants, incluant des jeux de table de casino d’une elegance mystique. Le service client du casino est un charme puissant, assurant un support de casino immediat et ensorcelant. Les transactions du casino sont simples comme un enchantement, par moments plus de tours gratuits au casino ce serait magique. Pour resumer, Luckster Casino est un casino en ligne qui porte chance pour les amoureux des slots modernes de casino ! De surcroit le site du casino est une merveille graphique enchantee, donne envie de replonger dans le casino sans fin.

luckster casino sister sites|

маркетинговое продвижение бренда Маркетинговое продвижение бренда Маркетинговое продвижение бренда – это комплекс стратегических мероприятий, направленных на формирование и укрепление позитивного имиджа компании в сознании целевой аудитории. Это не просто реклама, а создание устойчивых ассоциаций с вашим брендом, формирование лояльности и, в конечном итоге, увеличение продаж. Этапы продвижения бренда: Аудит бренда: Анализ текущего состояния бренда, выявление сильных и слабых сторон, определение целевой аудитории и конкурентов. Разработка стратегии: Определение целей продвижения, разработка позиционирования бренда, ключевых сообщений и каналов коммуникации. Разработка фирменного стиля: Создание визуальной идентичности бренда, включая логотип, цветовую палитру, шрифты и другие элементы. Разработка контент-стратегии: Создание контента, который отражает ценности бренда, привлекает целевую аудиторию и формирует экспертный имидж компании. Реализация стратегии: Запуск рекламных кампаний, продвижение в социальных сетях, участие в мероприятиях, работа со СМИ и другие активности. Мониторинг и анализ: Отслеживание результатов продвижения, анализ эффективности каналов коммуникации, внесение корректировок в стратегию. Основные инструменты: Реклама: Размещение рекламы в различных каналах (онлайн и офлайн) для привлечения внимания к бренду. PR: Формирование позитивного общественного мнения о бренде через работу со СМИ и общественностью. SMM: Продвижение бренда в социальных сетях для установления контакта с целевой аудиторией и формирования лояльного сообщества. Контент-маркетинг: Создание и распространение полезного и интересного контента для привлечения и удержания аудитории. Event-маркетинг: Организация и участие в мероприятиях для повышения узнаваемости бренда и установления контакта с потенциальными клиентами. Инвестиции в продвижение бренда – это инвестиции в будущее вашего бизнеса. Грамотно выстроенная стратегия позволит вам выделиться на фоне конкурентов, привлечь лояльных клиентов и увеличить прибыль.

услуги pr сопровождения Запуск нового продукта на рынок: Стратегия успеха от идеи до продаж Запуск нового продукта на рынок – это захватывающее, но сложное предприятие, требующее тщательной подготовки, стратегического планирования и безупречного исполнения. Успех запуска зависит от множества факторов, от качества самого продукта до эффективности маркетинговой кампании. Я предлагаю комплексный подход к запуску новых продуктов, который поможет вам минимизировать риски, максимизировать возможности и добиться выдающихся результатов. Основные этапы запуска нового продукта: Исследование рынка и целевой аудитории: Глубокий анализ рынка, чтобы определить потенциальный спрос на ваш продукт, выявить целевую аудиторию и изучить конкурентную среду. Разработка уникального продукта: Создание продукта, который отвечает потребностям и желаниям вашей целевой аудитории и обладает уникальными преимуществами перед конкурентами. Стратегия позиционирования: Определение ключевых характеристик продукта и формирование убедительного сообщения, которое привлечет внимание целевой аудитории. Разработка маркетинговой стратегии: Создание комплексной маркетинговой стратегии, включающей в себя все необходимые каналы коммуникации, бюджет и план действий. Создание маркетинговых материалов: Разработка привлекательных и убедительных маркетинговых материалов, включая сайт, лендинг, рекламные баннеры, видеоролики, презентации и пресс-релизы. Предпродажная подготовка: Обучение персонала, подготовка отдела продаж к работе с новым продуктом и создание системы поддержки клиентов. Запуск продукта: Организация масштабной рекламной кампании, проведение мероприятий, участие в выставках и конференциях. Мониторинг и анализ результатов: Постоянный мониторинг результатов запуска продукта, анализ данных и внесение корректировок в стратегию для достижения максимальной эффективности. Ключевые факторы успеха запуска нового продукта: Инновационный продукт: Продукт должен быть уникальным, полезным и отвечать потребностям целевой аудитории. Четкое позиционирование: Продукт должен иметь четкое позиционирование и выгодно отличаться от конкурентов. Эффективная маркетинговая стратегия: Стратегия должна быть направлена на привлечение внимания целевой аудитории и стимулирование продаж. Квалифицированный персонал: Команда должна обладать необходимыми знаниями и опытом для успешного запуска продукта. Постоянный мониторинг и анализ: Необходимо постоянно отслеживать результаты запуска и вносить корректировки в стратегию. Запуск нового продукта – это шанс изменить рынок и создать успешный бизнес. Подготовьтесь к нему тщательно и доверьтесь опытному партнеру, чтобы реализовать ваш потенциал!

Exclusive jackpots attract attention and add more thrill to the sessions. Across India, many users choose casino. vavada. com. for its localized offers and flexible deposits. Regular tournaments keep the pace dynamic and reward consistent play. Support resources explain wagering, eligible titles and time limits in simple terms. Mobile-friendly layout helps to play and track progress on the go.

Most users appreciate fast onboarding and straightforward verification steps. Support resources explain wagering, eligible titles and time limits in simple terms. Weekly promos and prize pools are announced ahead of time to plan participation. Mobile-friendly layout helps to play and track progress on the go. If you are looking for exciting tournaments, https://bloguilea.com is frequently mentioned among the top platforms. Many players highlight generous bonuses and smooth gameplay across seasonal campaigns.

imipramine sedation

https://dzen.ru/110km Новости Мира Авто Новости мира авто – это ваш портал в глобальную автомобильную индустрию. Мы следим за событиями, происходящими на всех континентах, чтобы предложить вам полную и объективную картину автомобильного мира. От инновационных разработок в Китае до классического дизайна в Италии, от гоночных трасс Европы до пустынных ралли Африки – мир автомобилей разнообразен и полон сюрпризов. Что вы найдете на нашем портале: Обзоры мировых рынков: Анализ автомобильных рынков разных стран, включая объемы продаж, предпочтения потребителей, государственные программы поддержки и тенденции развития. Новости автопроизводителей: Информация о деятельности крупнейших мировых автопроизводителей, включая планы развития, инвестиции, новые модели и технологии. Международные автосалоны: Репортажи с крупнейших международных автосалонов, таких как Женевский, Франкфуртский, Детройтский и Пекинский автосалоны. Глобальные тенденции: Обзор глобальных тенденций в автомобильной индустрии, включая развитие электромобилей, автономного вождения, подключенных автомобилей и каршеринга. Автоспорт в мире: Новости автоспорта со всего мира, включая Formula 1, WRC, MotoGP, DTM и другие серии. Экологические инициативы: Информация о новых технологиях, направленных на снижение выбросов вредных веществ и повышение экологичности автомобилей. Автомобильная культура: Рассказы об автомобильной культуре разных стран, включая автомобильные клубы, фестивали и музеи. Преимущества нашего портала: Глобальный охват: Мы следим за событиями, происходящими во всех уголках мира, чтобы предложить вам полную картину автомобильного мира. Экспертный анализ: Мы привлекаем экспертов и аналитиков для оценки тенденций и прогнозирования развития автомобильного рынка. Актуальность: Мы оперативно публикуем новости, чтобы вы всегда были в курсе самых последних событий. Удобство: Наш сайт разработан таким образом, чтобы вы могли легко и быстро находить нужную вам информацию. Объективность: Мы стараемся представлять информацию без предвзятости, предоставляя различные точки зрения на происходящее. Подписывайтесь на наши новости и будьте в курсе всех событий, происходящих в автомобильном мире! Откройте для себя мир автомобилей вместе с нами!

https://2news.com.ua/ Новости Украины

Your comment is awaiting moderation.

В 2025 году интернет в России продолжает меняться: блокировки сайтов и ограничение доступа к YouTube, социальным сетям и новостным ресурсам остаются актуальной проблемой. Для миллионов пользователей единственным способом сохранить привычный онлайн-образ жизни стал VPN. Но не каждый сервис стабильно работает — часть решений блокируется, другие теряют скорость или перестают подключаться.

В анонсе мы разберём, какие VPN реально работают в РФ сегодня, на что обратить внимание при выборе и почему важно выбирать сервисы с современными протоколами и европейскими серверами.

Почему VPN не умирают в России — блокируются лишь IP-адреса, но новые технологии вроде VLESS Reality и WireGuard позволяют обходить фильтры.

Какие критерии важны — высокая скорость для YouTube и стриминга, защита данных, поддержка нескольких устройств.

ТОП-3 рабочих VPN 2025 года:

Youtuber VPN — до 5 устройств на одной подписке, максимальная скорость для видео, 3 дня бесплатно, европейские сервера и круглосуточная поддержка.

AdGuardo VPN — доступный вариант для одного устройства, стабильная работа и простая настройка.

Ruski VPN — оптимален для тех, кто живёт за границей и хочет пользоваться российскими сервисами (Госуслуги, банки, ЖКХ).

Кроме того, в материале вы найдете советы по безопасному использованию VPN: зачем менять протоколы, какие DNS лучше выбрать, почему не стоит доверять бесплатным приложениям.

Итог: в 2025 году VPN по-прежнему остаётся надежным инструментом для свободы в сети. Главное — правильно выбрать сервис, который работает именно сегодня, а не вчера.

Читать далее: https://impossible-studio.ghost.io/kakiie-vpn-rabotaiut-v-rf-v-2025-ghodu-podrobnyi-obzor-i-soviety/

Реплики люксовых брендов Оригинальные бренды Оригинальные бренды – это компании и производители, которые разрабатывают и создают уникальные продукты или услуги, обладающие собственным, узнаваемым стилем, качеством и репутацией. Они инвестируют значительные ресурсы в исследования и разработки, дизайн, маркетинг и защиту своей интеллектуальной собственности. Приобретение оригинальных брендов – это выбор в пользу качества, долговечности, инноваций и поддержки креативных индустрий. Оригинальные бренды предлагают не просто товары, а воплощают определенные ценности, образ жизни и философию. Они создают историю и традиции, которые передаются из поколения в поколение. Преимущества выбора оригинальных брендов: Высокое качество: оригинальные бренды используют лучшие материалы, передовые технологии и строгий контроль качества на всех этапах производства. Уникальный дизайн: оригинальные бренды предлагают эксклюзивные дизайны, которые отличаются от массовой продукции и отражают индивидуальность потребителя. Инновации: оригинальные бренды постоянно разрабатывают новые продукты и услуги, чтобы удовлетворить потребности своих клиентов и превосходить их ожидания. Репутация: оригинальные бренды имеют заслуженную репутацию надежных и ответственных производителей. Поддержка: оригинальные бренды обеспечивают качественную поддержку своих клиентов, включая гарантийное обслуживание, консультации и обучение. Этичность: покупка оригинальных брендов поддерживает легальный бизнес и препятствует распространению подделок. В нашем магазине вы найдете широкий ассортимент оригинальных брендов из разных категорий: мода, красота, технологии, товары для дома и многое другое. Мы тщательно отбираем бренды, чтобы предложить вам только самые лучшие и надежные продукты. Мы уверены, что вы по достоинству оцените качество, стиль и инновации оригинальных брендов. Выбирайте оригинальные бренды – поддерживайте творчество, качество и инновации!

Женский портал https://devchenky.ru секреты красоты, модные тенденции, здоровье, любовь и кулинария. Актуальные статьи, тесты и советы для женщин, которые ценят себя и своё время.

Портал о строительстве https://e-proficom.ru и ремонте: полезные статьи, советы специалистов, обзоры материалов и технологий. Всё для тех, кто планирует ремонт квартиры, дома или дачи.

https://aa-p.ru/ Сельхоззапчасти Бесперебойная работа сельскохозяйственной техники крайне важна для успешного ведения аграрного бизнеса. Выход из строя даже незначительной детали может привести к серьезным простоям и убыткам. Наша компания предлагает широкий выбор сельхоззапчастей для различных видов сельскохозяйственной техники, обеспечивая оперативное восстановление работоспособности вашего оборудования и минимизируя время простоя. Мы предлагаем сельхоззапчасти для: Тракторов: Запчасти для двигателей, трансмиссий, ходовой части, гидравлики, электрооборудования. Комбайнов: Запчасти для двигателей, жаток, молотилок, сепараторов, измельчителей, систем выгрузки. Почвообрабатывающей техники: Запчасти для плугов, культиваторов, дисковых борон, глубокорыхлителей. Посевной техники: Запчасти для сеялок, сажалок, разбрасывателей удобрений. Кормозаготовительной техники: Запчасти для косилок, граблей, пресс-подборщиков, обмотчиков. Опрыскивателей: Запчасти для насосов, распылителей, шлангов, фильтров. Мы предлагаем как оригинальные сельхоззапчасти от производителей техники, так и высококачественные аналоги от проверенных поставщиков. Наши квалифицированные специалисты помогут вам подобрать необходимые запчасти, учитывая модель вашей техники, ее технические характеристики и ваши финансовые возможности. Преимущества работы с нами: Широкий ассортимент: Более 10 000 наименований запчастей в наличии. Гарантия качества: Мы работаем только с проверенными поставщиками и гарантируем качество продукции. Конкурентные цены: Мы предлагаем выгодные цены на все сельхоззапчасти. Быстрая доставка: Оперативная доставка заказов по всей стране. Профессиональная консультация: Наши специалисты помогут вам подобрать необходимые запчасти. Удобная система поиска: Легкий и быстрый поиск запчастей по каталогу. Не допускайте потери урожая из-за простоя техники! Обращайтесь к нам за качественными сельхоззапчастями, и мы поможем вам обеспечить бесперебойную работу вашего оборудования!

разработка сайтов Создание сайтов: От идеи до воплощения онлайн-присутствия В современном цифровом мире сайт – это не просто визитная карточка, а мощный инструмент для развития бизнеса, привлечения клиентов и укрепления имиджа компании. Услуги по созданию и разработке сайтов охватывают широкий спектр задач: от проектирования структуры и дизайна до написания кода и наполнения контентом. Разработка сайта: Путь к эффективному онлайн-решению Разработка сайта – это сложный и многоэтапный процесс, требующий профессионального подхода. Он включает в себя анализ целевой аудитории, определение целей и задач сайта, разработку технического задания, создание макета и дизайна, верстку и программирование, тестирование и отладку. Важно выбрать надежного подрядчика, который сможет предложить оптимальное решение, соответствующее вашим потребностям и бюджету. Сайт под ключ: Комплексное решение для вашего бизнеса Услуга разработки сайта под ключ предполагает полный цикл работ: от разработки концепции до запуска и продвижения готового продукта. Это позволяет заказчику получить готовый к работе сайт, не тратя время и ресурсы на решение технических вопросов. Стоимость разработки сайта под ключ зависит от сложности проекта, функциональности и дизайна.

услуга интернет маркетолога Маркетинговое продвижение бренда Маркетинговое продвижение бренда – это комплекс стратегических мероприятий, направленных на формирование и укрепление позитивного имиджа компании в сознании целевой аудитории. Это не просто реклама, а создание устойчивых ассоциаций с вашим брендом, формирование лояльности и, в конечном итоге, увеличение продаж. Этапы продвижения бренда: Аудит бренда: Анализ текущего состояния бренда, выявление сильных и слабых сторон, определение целевой аудитории и конкурентов. Разработка стратегии: Определение целей продвижения, разработка позиционирования бренда, ключевых сообщений и каналов коммуникации. Разработка фирменного стиля: Создание визуальной идентичности бренда, включая логотип, цветовую палитру, шрифты и другие элементы. Разработка контент-стратегии: Создание контента, который отражает ценности бренда, привлекает целевую аудиторию и формирует экспертный имидж компании. Реализация стратегии: Запуск рекламных кампаний, продвижение в социальных сетях, участие в мероприятиях, работа со СМИ и другие активности. Мониторинг и анализ: Отслеживание результатов продвижения, анализ эффективности каналов коммуникации, внесение корректировок в стратегию. Основные инструменты: Реклама: Размещение рекламы в различных каналах (онлайн и офлайн) для привлечения внимания к бренду. PR: Формирование позитивного общественного мнения о бренде через работу со СМИ и общественностью. SMM: Продвижение бренда в социальных сетях для установления контакта с целевой аудиторией и формирования лояльного сообщества. Контент-маркетинг: Создание и распространение полезного и интересного контента для привлечения и удержания аудитории. Event-маркетинг: Организация и участие в мероприятиях для повышения узнаваемости бренда и установления контакта с потенциальными клиентами. Инвестиции в продвижение бренда – это инвестиции в будущее вашего бизнеса. Грамотно выстроенная стратегия позволит вам выделиться на фоне конкурентов, привлечь лояльных клиентов и увеличить прибыль.

https://t.me/s/tripscan_1 tripscan трипскан tripskan трип скан

https://autoevak-46.ru/

Всё о Москве https://moscowfy.ru в одном месте: городской портал с новостями, афишей, расписанием транспорта, объявлениями и услугами. Полезные материалы для москвичей и туристов.

Портал про авто https://ivanmotors.ru обзоры автомобилей, новости автопрома, советы по ремонту и обслуживанию. Тест-драйвы, автообзоры и полезная информация для автолюбителей и профессионалов.

Your comment is awaiting moderation.

Je suis totalement ensorcele par Lucky8 Casino, ca degage une vibe de jeu petillante comme une comete. La selection du casino est une explosion de plaisirs, avec des machines a sous de casino modernes et envoutantes. Les agents du casino sont rapides comme un souhait exauce, joignable par chat ou email. Le processus du casino est transparent et sans malefice, mais des recompenses de casino supplementaires feraient rever. Au final, Lucky8 Casino est un casino en ligne qui porte chance pour les chasseurs de fortune du casino ! En plus l’interface du casino est fluide et rayonnante comme une aurore, ce qui rend chaque session de casino encore plus envoutante.

@solow:https://lucky8.onelink.me/mkr4/be 73367c|

Ich finde absolut magisch LuckyNiki Casino, es fuhlt sich an wie ein verzauberter Glucksrausch. Der Katalog des Casinos ist eine Galaxie voller Vergnugen, inklusive eleganter Casino-Tischspiele. Der Casino-Support ist rund um die Uhr verfugbar, ist per Chat oder E-Mail erreichbar. Casino-Zahlungen sind sicher und reibungslos, ab und zu mehr regelma?ige Casino-Boni waren zauberhaft. Am Ende ist LuckyNiki Casino ein Online-Casino, das wie ein Sternenhimmel strahlt fur Fans von Online-Casinos! Nebenbei die Casino-Seite ist ein grafisches Meisterwerk, das Casino-Erlebnis total verzaubert.

luckyniki bonus|

Je trouve absolument magique Luckster Casino, c’est un casino en ligne qui brille comme un talisman. Le repertoire du casino est une cascade de divertissement, proposant des slots de casino a theme feerique. Le personnel du casino offre un accompagnement enchante, avec une aide qui fait des miracles. Les transactions du casino sont simples comme un enchantement, par moments plus de tours gratuits au casino ce serait magique. En somme, Luckster Casino est un joyau pour les fans de casino pour les joueurs qui aiment parier avec panache au casino ! De surcroit la navigation du casino est intuitive comme un sortilege, ce qui rend chaque session de casino encore plus magique.

luckster promo code|

J’adore le charme de Luckster Casino, ca pulse avec une energie de casino envoutante. La collection de jeux du casino est un veritable grimoire, proposant des slots de casino a theme feerique. Le support du casino est disponible 24/7, repondant en un eclat de magie. Les retraits au casino sont rapides comme un coup de baguette, parfois plus de tours gratuits au casino ce serait magique. En somme, Luckster Casino promet un divertissement de casino scintillant pour ceux qui cherchent l’adrenaline enchantee du casino ! A noter le site du casino est une merveille graphique enchantee, facilite une experience de casino enchanteresse.

luckster login|

накрутка активных подписчиков в тг

Je suis fou de LeoVegas Casino, il propose une aventure de casino digne d’une couronne. Le repertoire du casino est un palais de divertissement, incluant des jeux de table de casino d’une elegance royale. Le service client du casino est digne d’un monarque, avec une aide qui inspire le respect. Les transactions du casino sont simples comme un edit, par moments j’aimerais plus de promotions de casino qui eblouissent. Dans l’ensemble, LeoVegas Casino promet un divertissement de casino royal pour ceux qui cherchent l’adrenaline majestueuse du casino ! Par ailleurs le site du casino est une merveille graphique princiere, amplifie l’immersion totale dans le casino.

leovegas 入出金|

Je suis totalement ensorcele par LeoVegas Casino, ca degage une vibe de jeu princiere. La selection du casino est une veritable cour de plaisirs, avec des machines a sous de casino modernes et envoutantes. Le personnel du casino offre un accompagnement majestueux, proposant des solutions claires et immediates. Les retraits au casino sont rapides comme un couronnement, par moments j’aimerais plus de promotions de casino qui eblouissent. Globalement, LeoVegas Casino c’est un casino a conquerir en urgence pour les joueurs qui aiment parier avec panache au casino ! Par ailleurs le design du casino est une fresque visuelle royale, facilite une experience de casino grandiose.

casino leovegas|

Ich liebe die unbandige Kraft von Lowen Play Casino, es pulsiert mit einer unbezahmbaren Casino-Energie. Der Katalog des Casinos ist ein Dschungel voller Nervenkitzel, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Die Casino-Mitarbeiter sind schnell wie ein Gepard, antwortet blitzschnell wie ein Lowenangriff. Der Casino-Prozess ist klar und ohne Fallen, dennoch die Casino-Angebote konnten gro?zugiger sein. Zusammengefasst ist Lowen Play Casino ein Muss fur Casino-Fans fur Fans von Online-Casinos! Extra das Casino-Design ist ein optisches Raubtier, was jede Casino-Session noch wilder macht.

löwen play memmingen hallhof|

Acho simplesmente insano JabiBet Casino, da uma energia de cassino que e uma mare alta. As opcoes de jogo no cassino sao ricas e eletrizantes, com caca-niqueis de cassino modernos e envolventes. O atendimento ao cliente do cassino e uma mare de qualidade, acessivel por chat ou e-mail. Os saques no cassino sao velozes como um redemoinho, porem mais recompensas no cassino seriam um diferencial brabo. Na real, JabiBet Casino e um cassino online que e uma onda gigante para os viciados em emocoes de cassino! Alem disso a interface do cassino e fluida e cheia de energia oceanica, aumenta a imersao no cassino como uma onda gigante.

jabibet|

живые подписчики в телеграм канал

https://xn—86-5cdoa3a7cs.xn--p1ai/

монтаж кровли плоской крыши https://ploskaya-krovlya-pod-klyuch.ru

Ich bin vollig hingerissen von Lowen Play Casino, es verstromt eine Spielstimmung, die wie eine Savanne tobt. Die Spielauswahl im Casino ist wie eine wilde Horde, mit modernen Casino-Slots, die einen in ihren Bann ziehen. Der Casino-Service ist zuverlassig und machtig, liefert klare und schnelle Losungen. Auszahlungen im Casino sind schnell wie ein Raubkatzen-Sprint, ab und zu mehr Casino-Belohnungen waren ein koniglicher Gewinn. Zusammengefasst ist Lowen Play Casino ein Online-Casino, das die Savanne beherrscht fur Abenteurer im Casino! Und au?erdem die Casino-Oberflache ist flussig und strahlt wie ein Sonnenaufgang, was jede Casino-Session noch wilder macht.

promo code löwen play|